Winter 2019/20 Newsletter

Need some help with your financial resolutions?

Many individuals will have started 2020 with at least one New Year’s resolution but how many will have focussed on financial goals or aspirations? With today’s complex financial environment, achieving these may not be straightforward and therefore financial planning is essential.

Designed to help secure your financial future, a financial plan seeks to identify your financial goals, prioritise them and then outline the exact steps that you need to take to achieve your goals. If your New Year’s resolutions include giving your financial plans an overhaul, below are some suggestions to help create a robust plan for the coming year and beyond.

Be specific

Any goal without a clear objective is nothing more than a pipe dream and it is often said that saving and investing are nothing more than deferred consumption. Therefore, you need to be crystal clear about what you are doing and why.

Once the objective is clear, it’s important to put a monetary value to that goal and then apply a time frame you want to achieve it by.

Be realistic

Whilst it can be good to be optimistic surrounding your future financial goals and to push yourself hard to achieve them, it is also important to be realistic. This will help you to stay the course and keep you motivated throughout your journey until you get to your destination.

Think Short, Medium and Long-Term

When mapping out your financial future, consider dividing your goals and aspirations into short-term (less than 5 years), medium-term (5-10 years) and long-term (over 10 years) time horizons.

Splitting these goals into a timeline will help determine the right saving and investments approach and help plan for future capital expenditure events.

The impact of inflation

When planning ahead and assigning a monetary value to a financial goal, consider how inflation may affect your returns and ultimately whether you achieve a profit in real terms (after inflation).

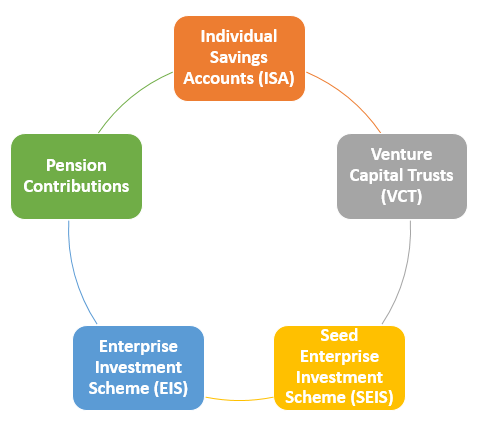

Use your Tax Allowance

Tax will have an influence on your returns and therefore you should ensure you are taking advantage of the various tax allowance that are available. This could impact future income, capital gains or inheritance tax liability.

Remember that tax rules constantly change so it is important to regularly review your tax position.

Risk Protection

A well-structured financial plan should consider the potential for an unexpected event to potentially “de-rail” or delay achieving a set goal. This can be achieved by cashflow modelling and stress-testing future returns.

Other elements to consider should include a Will to protect your family and ensuring adequate financial protection is in place to cover the loss of income should you die prematurely or fall ill.

Retirement Options

Since 2015, Pension Freedom has provided individuals with an increased range of options when it comes to taking your pension. This could combine the taking of a tax-free lump sum, securing a fixed income or drawing income direct from your pension fund.

Without fully knowing and understanding the options open to you, it will be very difficult to create an appropriate retirement plan.

The earlier you start planning for your retirement, the greater the chance of achieving your goals.

Monitor and Review

If you are committed to a successful financial planning strategy, a key component must include regular monitoring of your plan to assess whether it is on track to deliver your aspirations.

This should include reviewing your savings and investments, assessing your risk and confirming that based on your on-going circumstances your goals remain relevant and appropriate.

Please do contact your adviser to discuss your financial planning needs.

How tax efficient are you?

2019/20 ISA Allowance – use it or lose it!

An Individual Savings Account (ISA) enables you to save in a simple, tax-efficient way, while generally giving you instant access to your money.

This gives you short, medium and long-term savings options, and with the end of the current tax year not too far away, it's important to make the most of your annual tax-free ISA allowance.

UK residents age 16 or ocver can save up to £20,000 a year (for the 2019/20 tax year) into a cash ISA. Those aged 18 or over can save in a Cash or Stocks & Shares ISA, or combination of ISAs.

Tax-Efficient Wrapper

ISAs are a very tax-efficient wrapper in which you can buy, hold and sell investments. For any ISA contributions to count for the current tax year, you must save or invest by 5th April. Also, don't forget that any unused ISA allowance cannot be rolled over into a subsequent tax year, so if you don't use it, you've lost it forever.

Which ISA?

Cash ISAs – savings accounts that are tax-free, with the maximum allowable contribution set at £20,000 in the current tax year.

Junior ISAs – tax-free savings accounts in which under-18s can save or invest maximum contributions up to £4,368 in the current tax year.

Stocks & Shares ISAs – tax-efficient with the maximum allowable contribution set at £20,000.

Innovative Finance ISAs – peer to-peer lending investments that are classed as tax-efficient, with the maximum allowable contribution set at £20,000 in the current tax-year. They are considered high risk ,and it may not be possible to get your money out quickly. Some may not be protected by the Financial Services Compensation Scheme.

Lifetime ISAs – these can be either classed as savings (tax-free) or investments (tax-efficient). You must be aged between 18 to 39, and the maximum allowable contribution is set at £4,000 in the current tax year.

Help to Buy ISAs – these were set up to help those saving for their first home and were only available to new savers until 30 November 2019. Existing savers can continue saving, although they must claim their government bonus by 1st December 2030.

The value of investments and income from them can go down as well as up. You may get back less than the full amount invested. The tax treatment of ISAs depends on your circumstances and may change in the future

Is an annuity right for you?

Have you considered how your pension is going to work for you when you retire?

Will it be able to provide you with the income you need to live comfortably? One way to help is to buy an annuity. But what does this mean, and what are the pros and cons?

Simply put, an annuity is a product for insurance. If you pay a lump sum amount to an annuity provider, they will pay you a guaranteed, regular income until you die (life-time annuity).

A lot of providers offer variations in their annuity rates. If you have lifestyle or health issues, you may find that you could be granted a larger annuity – an enhanced annuity.

A standard annuity stops once you’ve died, however it’s possible to acquire a joint-life annuity that covers both spouses, which pays out a small amount until you both die, but it’s best to discuss all your options with your financial adviser before you decide. You can also opt for some guarantee on your annuity which will pay out for a minimum time period if you die sooner than expected.

Whilst an annuity provides you with security and certainty, you do have to commit your pension fund to a specific interest rate which may not be attractive. In addition, purchasing an annuity will not provide income flexibility in retirement or the ability to continue to grow your pension pot.

As an alternative, Pension Drawdown will allow you to keep your pension invested and you can draw income direct from your fund. You would have to be careful that you do not deplete you fund and be wary that investment performance could impact your income levels.

Makes sure you discuss you circumstances with your adviser to help determined which is the best option for you.

The name’s Bond. Investment Bond.

When you buy an investment fund, you may choose to do so via a wrapper which helps confer certain tax benefits on the income and capital gains which you receive. An investment bond is one of the wrappers you can use.

Investment bonds are generally available for a single premium – that is, a one-off lump sum. You can choose how that money is invested from a range of options that combine a variety of different asset classes within the one fund. Life companies offer external links to fund management houses, increasing your scope to mix, match and specialise within your portfolio.

Funds within an investment bond pay tax equivalent to the basic rate and there is therefore no specific benefit to help such investors save tax. However, for higher rate taxpayers, it does offer the chance to defer any liability incurred on gains - and potentially reduce them in the process.

For example, under income tax deferral rules, you can withdraw up to 5% of your initial investment each year, without becoming immediately liable for tax on it. This amount can be withdrawn every year for up to 20 years and it is not until you cash in the entire investment bond that you are assessed, and must pay, that additional tax on any gains.

This postponement of the tax liability can be particularly advantageous if you are a higher rate taxpayer now but expect to become a basic rate taxpayer in future, perhaps after retirement. The tax charge applies at the rate you are paying when the bond is encashed, not when the income was taken. As the bond has already been paying the equivalent of basic rate tax during its term, in this example, you would end up owing nothing more.

The structure of investment bonds means they can also offer facilities that some mutual funds cannot. Phased switching, to and from cash funds, for example, can help you drip into or out of a volatile fund. And, as life assurance products, they also carry life cover which guarantees your original capital should the worst happen. However, you should be aware that, if your main objective is growth, particularly for higher rate taxpayers, there may be other, more tax advantageous ways to invest.

Top 10 performing IMA sectors in 2019

| 1 | Technology & Telecommunications | 31.0% | 6 | China / Global China | 22.2% |

| 2 | North American Smaller Companies | 25.8% | 7 | Global | 21.9% |

| 3 | UK Smaller Companies | 25.3% | 8 | Europe including UK | 20.9% |

| 4 | North America | 24.4% | 9 | European Smaller Companies | 20.3% |

| 5 | UK All Companies | 22.2% | 10 | Europe excluding UK | 20.3% |

Total return performance figures are calculated with net income (dividends) reinvested.

Source: Trustnet 21.02.2020

The attractions of equity income

During times when interest rates are low and rates on cash deposits are meagre, many investors look for alternative ways to boost their income stream. For some investors, the answer may lie in equity income.

Given that dividends are paid out of profits, a company that pays a dividend is likely to be relatively mature; companies that are new or still in the expansion phase are less likely to pay a dividend. Therefore, companies that can pay high dividends tend to be comparatively well established with robust balance sheets, stable operations, strong cash flow and are positioned to deliver positive performance over the long term.

Equity markets can be volatile, and therefore it is important to remember to take a long-term view. The value of shares will go down as well as up but knowing that there is a regular dividend payment available can help make up for some of that uncertainty. However, a successful equity income strategy is not merely a matter of picking the company that pays the highest dividend.

Even well-established companies can decide to cut or cancel their dividend during difficult periods, and we sometimes see cancellations when – for example, during a period of recession – firms need to hold onto their profits. If there is uncertainty about a company’s financial position, management is more likely to favour cancelling pay-outs to shareholders in the short term than risk falling into long-term disrepair.

As an investor, therefore, a well-diversified portfolio is the best way to protect yourself from the risk that one or two companies might take this decision, and it may be worth considering one of the many UK equity income funds available. To be eligible for the Investment Association’s UK Equity Income sector, a fund must invest at least 80% of its assets in UK equities and have a yield of at least 100% of the yield of the FTSE All Share Index on a three-year rolling basis. However, to be successful in the long term, an equity income strategy needs to balance better-than-average yields with the potential for some capital growth. You just need to find the mix that’s right for you.

The value of investments and income from them can go down as well as up. You may get back less than the full amount invested

Going for gold this summer?

The Royal Mint (RM) is making buying gold easier, but pension savers hoping to take advantage of the service should beware that they face a tax charge for holding gold coins.

Firstly, do be mindful that investing in Physical gold would be considered as only suitable for High Net Worth clients as it is not regulated by the FCA and is not protected by the Financial Ombudsman Service (FOS) or the Financial Services Compensation Scheme (FSCS)

The RM has a bullion trading website that enables individuals to buy, store and sell bullion and coins 24 hours a day and 365 days a year. Once an account is set up, consumers will be able to buy brand new RM Britannia, Sovereign and Lunar bullion coins.

Sovereign coins are made from 22-carat gold, while Britannia coins are available in either 99.9% fine gold, or 99% fine silver, as are Lunar coins. The coins can either be sent directly to the buyer, or placed in the RM’s vault, which is protected by the Ministry of Defence. This adds on an extra 1% on the price of the coin plus VAT, so if £5,000 is invested a flat rate of 1% is £50 a year plus £10 VAT, totalling £65.

The Mint said it introduced the service because research showed there was up to £4 billion of ‘latent demand’ for gold investment in the UK but consumers did not know how to buy physical gold and were worried about storing it if they did buy it.

The tax status of gold coins is VAT-free and growth in the value is free of capital gains tax (CGT), as the coins are considered legal tender.

Holding gold for retirement

If you have a SIPP or a SASS then you can invest in physical gold, as can funds that invest in gold. However, in order to hold real gold bullion in a pension it needs to meet three strict criteria:-

- Gold must be of a certain investment grade; a purity of no less than 99.5%.

- Must be held in a secure environment like a vault (usually this is done by a third party), but it must be accessible within 30 days

- The gold must be in the form of bars or a wafer (a sliver of gold).

Anyone who uses their Sipp to buy a gold coin could be liable to a tax charge on both the cost of the investment and any income made from it. There is a 55% tax charge if you buy something with your pension fund that you are not supposed to and you could also have to pay an unauthorised payment surcharge, and the tax charge could be up to 70% of the investment in total. There is also a scheme sanction charge on income of 40%.

The RM and others do offer gold bullion that is eligible for a pension scheme, with the RM they offer RM Refinery gold bullion bars in sizes of either 100g or 1kg and ‘Signature Gold’ which can be fractions of a 400oz gold bar, for storage in the RM Vault

The rise of the 40-year mortgage

When you think of a mortgage term you most likely think 25 years. But it would appear increasing numbers of lenders are allowing borrowers to extend their mortgage to a maximum of 40 years.

Advantages of extending the mortgage term to four decades are that the repayments are lower over a monthly basis.

However, on the flip side of the coin, it also means borrowers are extending the period over which they are paying interest and therefore could end up paying more over time.

There are also concerns, by stretching out mortgages for an additional 15 years many borrowers may still be repaying their home loan into retirement. But for all the pitfalls, it would seem many of the banks, building societies and other lenders are offering customers the option to extend their mortgage terms to meet a growing demand.

Figures out recently from Moneyfacts.co.uk, reveal the majority – 57% – of mortgages have maximum terms of 40 years. A high proportion – that is 35% according to Moneyfacts – also have maximum terms of 35 years. Meanwhile, those mortgages rigidly sticking to the traditional term of up to 25 years now only account for just under 3.5% of the market.

It is thought that one of the reasons behind this demand was the changing profile of a first-time buyer and their first home. Rather than newbies to the property market starting on the bottom step of the property ladder, older first-time buyers are aiming for larger, often detached homes.

If you are unsure about whether a longer-term mortgage is right for you or your family, do get in touch.

Your home may be repossessed if you do not keep up repayments on your mortgage

Cross-party support for IHT changes

Inheritance Tax (IHT) is a deeply unpopular tax. In its first report on inheritance tax the Office of Tax Simplification (OTS) called the measure “almost uniquely unpopular” (Nov 2018). It has also been described more bluntly as “Britain’s most hated tax” (Financial Times July 2019).

Dislike of IHT has been voiced across the political spectrum, with organisations calling for it to be scrapped, although not necessarily agreeing with the alternatives. The tax is perhaps most resolutely opposed by those who are least likely to pay it. Estate duty was described by Roy Jenkins, a former Chancellor of the Exchequer as a “voluntary levy paid by those who distrust their heirs more than they dislike the Inland Revenue.”

The All-Party Parliamentary Group for Inheritance & Intergenerational Fairness (APPG IIF) has published a report in which it recommends abolishing inheritance tax (IHT) in its current form and replacing it with an entirely different regime. Various leading policy research organisations and expert tax bodies gave evidence to the group during its deliberations. If adopted, its conclusions would replace the current array of IHT reliefs and exemptions, which would lead to a simplification of the IHT system.

What are the APPG’s recommendations?

Recommendation 1

The APPG recommends that policymakers replace the current IHT regime with a tax on lifetime and death transfers of wealth, with very few reliefs and a low flat rate, likely between 10% and 20%. The CGT tax-free death uplift would be abolished.

A flat-rate gift tax would operate on all lifetime gifts, with an annual gifts exemption of £30,000. This would take out most lifetime giving of smaller households where evidence suggests average lifetime gifts are under £5,000 per annum. There would be no nil rate band, which causes so many of the current complications. Instead there would be a death allowance, which could be set at a similar level to the current nil rate band of £325,000, but unlike the current nil rate band it would not be renewable every seven years as it would be available only on the death estate. The tax rate would be set at considerably lower than the current 40% IHT headline level, which would encourage less avoidance. Small estates would therefore not pay the gift tax, and larger estates could not avoid it as donors can do at present by making gifts and surviving seven years. The main home would continue to be included in the tax base, as would all businesses and farms.

The APPG recommends a low rate of tax, such as 10%. A crucial aspect of the design is that the rate is low enough to ensure the incentives to plan around it are not worthwhile and the pressure to give reliefs reduces. Evidence to the APPG suggests that rates above 20% start to incentivise planning. In short, the rate must be of an altogether different order from the present regime in order to allow the rest of the proposals to work properly.

Recommendation 2

The APPG recommends that HMRC and HMT are given greater powers to collect more meaningful data through compulsory electronic reporting of lifetime gifts over the current annual exemption of £3,000, even if they are not immediately taxed.

There should also be better collation of data that is already reported (e.g. lifetime gifts into trust). Overall analysis of data held by HMRC and HMT about how much and when wealth is transferred must be improved. Most cash lifetime gifts do not need to be declared if the donor survives seven years.

HMRC currently has limited information on quite basic issues such as the number and value of lifetime transfers into trust benefiting from business property relief; the total value of untaxed lifetime gifts; the cost of the CGT death uplift; and the number of exempt settlements set up by foreigners where there is a UK beneficiary or other UK connection. It is suggested that all lifetime gifts over a de minimis limit (say, £10,000) should be reported, even if they fall within the lifetime allowance. This should eliminate reporting and tax on small everyday gifts to dependents and relatives and, in fact, would be a more useful and less onerous reporting regime.

At present, when someone dies, the executors must work out all gifts over £3,000 each year for the last seven, and sometimes 14 years, in order to work out how much of the remaining death estate is taxable. Under the new regime, lifetime gifts would not affect the tax payable on death, thus making the job of executors much easier. The higher annual allowance would take most smaller gifts out of reporting and tax. However, as larger lifetime gifts over £30,000 per annum would be taxable and reportable immediately, the government would collect better data.

As we all know, the current IHT regime is complex and the recommendations are still just proposals at this stage. As you can image, the above is only a high-level overview and there is much more detail available should you wish to discuss it!

Whilst we would not suggest any specific changes to your current IHT planning, it is prudent to be aware that potential changes could be introduced.

Information is based on our current understanding of tax legislation and regulations. Levels and bases of taxation and tax reliefs are subject to change and their value depends on individual circumstances

HMRC practice and laws relating to taxation are complex and subject to individual circumstances and changes which cannot be foreseen

Make sure you claim your pension tax relief!

When you contribute to a pension, the Government gives you back the income tax you have already paid on that money. So if you are a basic-rate taxpayer, for every 80p of taxed income you pay into a pension, you will get back 20p. Higher-rate taxpayers (who earn more than £50,000) get back 40p for every 60p they pay in, and top-rate taxpayers (who earn more than £150,000) get back 45p income tax for every 55p they pay in.

But how is the tax relief paid?

When a pension contribution is paid into a money purchase pension scheme, the pension provider will automatically add basic-rate tax relief to an individual’s plan by adding the 20p for every 80p contributed. That takes care of the tax relief for a basic rate taxpayer and no further action is required.

However, higher-rate and top-rate taxpayers need to claim back the additional 20p and 25p respectively from HMRC. Many people who do not fill in a self-assessment form often forget to do this and can lose thousands of pounds a year. Relief can be made through completing a self-assessment form, a tax return form or by simply writing to HMRC advising of the gross annual contributions made.

Relief will be given through either an adjustment to your tax code or payment by cheque or direct into your bank account.

Integritas Financial Planners Ltd is an appointed representative of The Tavistock Partnership Ltd which is authorised and regulated by the Financial Conduct Authority. FCA No. 623126